The many ways Americans already pay for universal health care -- but don't have it.

"Are you crazy? A government health care system would be a bureaucratic nightmare!"

The many ways Americans already pay for a universal health care -- but don't have it.

Number 1 – Your employer:

Health care insurance is primarily provided by the private sector, generally through a group insurance plans negotiated with an employer, of which the employee pays an average of 27%. Then, of course as any accountant can tell you, those costs are expensed by the employer as a cost of doing business and recouped through pricing on goods and services. Therefore, every time you put out your hard earned dollar for anything, you are paying for someone’s health insurance. In fact, you are paying for many people’s health insurance on all the tiers of costs incurred as any product travels on the journey from raw materials to producer, from producer to middleman, from middleman to provider, from provider to the public. At each level, health insurance costs are part of the total cost.

Problems involved with number 1

Pretend you’re the owner of one of those few U.S. industries still operating in the manufacturing sector. The average cost of insuring each employee is $9,580 per year. If you have 100 employees, your prices must be high enough to recoup $958,000 annually, and for 1,000 employees $9,580,000 annually and so forth. And don’t forget that buried in the cost of any component of whatever it is you’re making, are the health insurance costs of those that produced it. (Assuming it is American made; which it most likely isn’t, because it’s too expensive to make things here, but let’s pretend.) But out there, in the market place, you are in competition on a global basis with foreign manufacturers who are not held responsible for their employees’ health insurance costs. In order to remain competitive, you must cut your expenses. So Mr. or Ms. Business Owner, what will be your first choice of costs to eliminate? Do you think this might have something to do with the choice to manufacture overseas?

Number 2 -- You:

You, the employees are paying an average of 27% of your own health insurance, as well as your deductible, as well as your co-pay portion.

Problems involved with Number 2

This 27% is a major reduction of your take home pay, an amount that doesn’t go very far in this day and age. So, you decide to visit the doctor only when you’re truly ill, and forgo those screening and preventative care visits even though you’re insured because those co-pays add up, and have to come out of your grocery budget, or you’ll have to sacrifice cable TV and the kids will drive you crazy then. So it seems like an intelligent decision at the time. Until you require major critical care for a condition that could have been detected and treated had it been caught earlier, and you’re suddenly responsible for 20% of some staggering costs, plus that deductible. And find yourself uninsurable afterward.

But even if you’re lucky, and stay in good health, the premium costs are continually climbing. Why? Because the cost of health services is continually increasing. Why? Because more and more Americans can no longer afford the premiums, but still get sick and show up at the hospitals, which are morally bound to treat them. After all, we can’t have people dying in the street like abandoned dogs, can we? A civilized society doesn’t do that.

Oh, by the way, the common myth that operating deficits in hospitals are due largely to the illegal aliens showing up for free care can be debunked right here. In the states with highest concentrations of illegal immigrants – Texas and California, non-documented aliens account for no more than 14% of those receiving non-insured care.

Naturally, the hospital has to recoup those costs – the ones they can’t squeeze out of the sick you, or your working wife/husband, or the equity in your home, or all of your savings, or your 401K. And they do that by spreading the cost of treating those who can’t pay but don’t qualify for public assistance, to those that can pay and their insurance carriers.

Then, naturally enough, the insurance carriers charge more for the premiums to cover that increased cost, which means that more Americans can no longer afford to pay for health care insurance. This, I believe is called a vicious circle.

Of course, they must. They are in business to make a profit, not to pay for medical care and making a profit is a tough thing to do. Isn’t it?

Here is a list of the CEO’s of some of the major health insurance corporations and how much they earn:

* Ron Williams - Aetna -

Total Compensation: $24,300,112.

* H. Edward Hanway - CIGNA - Total Compensation: $12,236,740.

* Angela Braly - WellPoint - Total Compensation: $9,844,212.

* Dale Wolf - Coventry Health Care - Total Compensation: $9,047,469.

* Michael Neidorff - Centene - Total Compensation: $8,774,483.

* James Carlson - AMERIGROUP - Total Compensation: $5,292,546.

* Michael McCallister - Humana - Total Compensation: $4,764,309.

* Jay Gellert - Health Net - Total Compensation: $4,425,355.

* Richard Barasch - Universal American - Total Compensation: $3,503,702.

* Stephen Hemsley - UnitedHealth Group - Total Compensation: $3,241,042.

Yep, it sure must be hard to make those profits. The trick to these profits? Get rid of any sick people on your list, and get rid of the ones who are at risk for being sick.

Number 3 – The Public Paid Programs

Those 65 or older get Medicare, paid for by taxes. The poor and medically needy, get Medicaid, paid for by taxes. Those at highest risk, the military, get Veteran’s Administration, paid for by taxes. Children of low income families get CHIP, paid for by taxes. Those above the means test for Medicaid but below whatever each state (and sometimes county) elects as a limit, usually 150% of the poverty level, get Country paid discounts for health care, paid for by taxes. And then, those employed by the Governments – Federal, State, County, and City or Town all get health insurance paid for by taxes, (but upon research this writer found those tax dollars go to the private insurance companies.) If you add up all the health care already paid by taxes, research shows that between 50-60% of the population is already covered.

Now add to this COBRA, that vehicle that was supposed to assist the newly unemployed maintain their insurance. Not only did these newly unemployed suddenly find their premiums escalating, the government chose to pay 67% of Cobra fees rather than put these people on Medicare. Now, as most of these people were in the lower risk categories, the cost to the taxpayer might have been next to nothing, relatively speaking, but instead the insurance companies are getting hundreds and hundreds of dollars each month, per person out of what can only be called a publicly funded subsidy.

The Inefficiencies that are creating further costs – to you the lowly insured taxpayer

Most of the insurance carriers are publicly own corporations, and one can, if one wishes, call them up and request a copy of their year-end financial statements. Do so, and look for their overhead accounts, in particular, accounting, clerical (all those people busy denying claims), office space, wages and benefits, computers and so forth – millions (many millions) and then multiply it by the number of companies in the health insurance business. (And for all my research skills, I’ve been unable to get an accurate number, and lost count after 155.)

Now add to that 50 states, each administering Medicaid, Medicare, Chip, SSI, SSP, County programs, City programs, none of them managed concurrently and all requiring their private fiefdoms.

Next, add the cost of accounting for all the veterans receiving medical benefits from Veterans Affairs.

All this duplication of administration -- this waste -- does nothing to assist in anyone’s health care yet, is included in the calculated cost of keeping the American public 42nd in the world for health care and longevity (just behind Chile 35th and Cuba 37th, and 72nd in overall health.

The estimated cost for all this administration of health care coverage in the U.S. is estimated, according to one Harvard study as $189 billion per year, and by another source as $350 billion dollars per year. (It’s probably safe to assume the truth as somewhere in between.)

In order to cope with all this myriad of administrations, doctors and hospitals must maintain costly administrative staffs and systems to deal with this amazing, mind boggling bureaucracy.

Combine these two, and all this needless administration consumes one-third of America’s health dollars.

Other costs impacting American society and the costs of their health care

Influence peddling

This past year, with the proposed (but failing) overhaul to the American health care industry, the insurers and drug makers have increased their lobbying efforts in order to protect their bottomless rice bowls. The lobbyists flocked to Washington bearing their gifts. Here are some interesting numbers. The Blue Cross and Blue Shield Association upped its lobbying expenditures to $2.8 million dollars; GlaxoSmithKline proffered $2.3 million; Novartis’ largess was $1.8 million; MetlifeGroup not to be outdone spread $1.7 million around the capitol, and Allstate $1.5 million. Johnson & Johnson had $1.6 million in their bag of goodies; America’s Health Insurance threw $2 million at your representatives, and Bayer wasn’t far behind. PhRMA spent $8.6 million in the first half of 2008, and report spending less this year by $700,000.

And the doctors, who one would normally think would love to see an end to this chaos, spent $8.2 million in the first part of this year alone.

Overall, the health care industry and their pet lobbyists spent money at the rate of $1.4 million a day.

Now guess who is paying for that – I dare you.

And the cost further down on the food chain

As more Americans each year are faced with crippling health care costs in the face of higher deductibles, or loss of insurance along with their jobs, and declare bankruptcy, but only after depleting their savings and pension funds, what will the future hold for those who approach their retirement years without the assets to support themselves? The baby-boomers -- that unnatural hump in the population’s demographics -- are approaching their late middle to late years with fewer resources than the previous two generations before them. This can only be a further drain on the nation’s resources.

The insurance companies tier their premium price to employers on such risk factors as age and previous illness – and the premium for someone aged 50 to 60 is three times higher than for those twenty to thirty years their junior who work in the same business. Doesn’t this motivate companies to sacrifice their loyal, long term employees to the bottom line? Age discrimination – illegal, but common practice.

Companies are refusing to insure their workers, resorting to hiring an assortment of part-time employees to avoid the issue. In the state of California, where the government is attempting to legislate mandatory coverage for employees, companies are downsizing to avoid the hefty cost.

And as 50-60% of the population is already covered by health care paid by the tax payer, the working uninsured are paying through their payroll deductions and taxes for health insurance in which they are unable to participate.

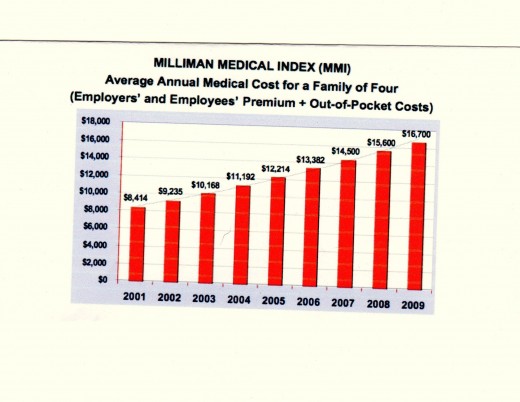

For the younger adult population – what is ahead of them? According to the Milliman Medical Index (MMI), the average annual medical cost for a family of four, (employers and employees premium, and out of pocket expenses), was $8,414 in 2001, and $9,235 in 2002. By 2006 it was $13,382 and in 2008 it is $15,600 and this year, 2009 $16,700. If this trend continues, this cost index will stand at $18,000 in 2010 – doubled in ten years. If we extrapolate the trend for another decade, America’s health system will extort $36,000 dollars per family of four.

The average mean wage in the U.S. for 2008 was $42,000. The average mean household income for a family is $60,000. Add in benefits, employee and employer portions and we arrive at the figure known as gross wage base – something accountants consider all those entries that go in to the account ‘Payroll,’ and it is from this the entire MMI is funded. Over the past decade, salaries have grown at around 3% annually (for those still working.) This growth rate in wages is unlikely to increase.

This means that in another ten years, health care will consume between 44% and 50% of the wage base of this family of four.

Millions and millions more families will find themselves joining the 47 million Americans without medical insurance.

· The last word. (A private thought by this writer)

As usual, I sit here writing after two days of research, with CNN on the television. Someone, and I don’t know who, just said, “I say, for all the indigent and those who can’t afford health insurance, let’s just cut them a check and tell them to go to Aetna and buy themselves some.”

Is this what you want?

NEW! Is the Affordable Care Act Affordable?

- Is the Affordable Health Care Act Affordable?

Is the Affordable Health Care Act truly affordable? A sharing of one person's experience.